The latest interest rate cuts are bringing into focus the low returns on cash. People complain about low interest rates but what if they were actually negative? In other words, what if the amount of money you got back at the end of the holding period was less than the amount invested at the beginning? Why would anyone actually pay someone to hold their cash?

We are living in strange times and for once, the past may not be a reliable guide.

A $10 Trillion market, and growing

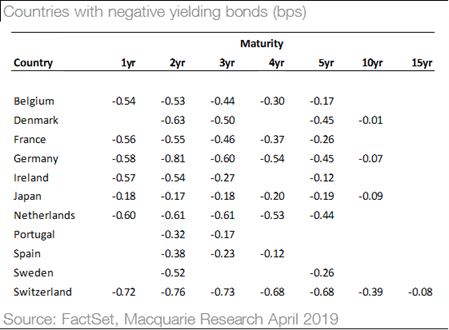

Australian private investors don’t like the low interest rates of today. They’d rather invest in anything that produces a better yield – often ignoring the differences in the underlying investments. But what may surprise the average personal investor is that worldwide, the total amount invested in negative yielding bonds is rising rapidly and is now over US$10 trillion!

Most of the investors in negative yielding bonds are institutions and considering all the expertise at their disposal they must have good reasons for doing so. Here are four reasons that make sense:

- The potential of deflation – returns are always relative so if there is a perception that prices will fall, the return of less capital in the future is not so big an issue.

- Government bonds may be negative in order to stimulate growth – governments may be willing to accept negative rates if their real purpose is to stimulate economic growth by providing very cheap capital.

- Some market participants need to hold certain instruments no matter what their returns – this applies to index funds and insurance companies who match assets and liabilities.

- No intention to hold to maturity – the buyer of this instrument may believe that interest rates will fall further, and they will therefore be able to sell at a profit.

What happens now?

The implications of this behaviour are important, particularly how they affect the average investor.

First, psychologically it’s difficult for private investors to accept such low interest rates. They are used to a reasonable rate of interest on their bank deposits and are holding cash to be ‘conservative’. Most of their investment life has seen them experience much higher rates and the result is that they move to investments with higher yields without fully understanding the risk. As part of this move, investors begin to contemplate non-traditional assets.

Second, it drives prices of high yielding assets as more and more money flows into them and third, it raises the correlation between risk assets reducing the impact of diversification.

We can expect the RBA to do whatever it can to avoid a recession as the Australian economy is beginning to struggle with potentially more bad news to come – given the weak housing market and debt-burdened consumers. In addition, the US has to slow down eventually while China already has, so we should expect low rates (possibly lower) in the years to come especially if there is an unexpected shock.

Be aware of the psychology

Investors cost themselves significant returns over their lifetimes and usually it’s a direct result of making a decision based on emotions. This is mostly prevalent when exposed to extreme financial

stimuli. Any move to other assets should be carefully considered – sometimes it’s about a return OF capital, not a return ON capital.