“Prime of Life” Research

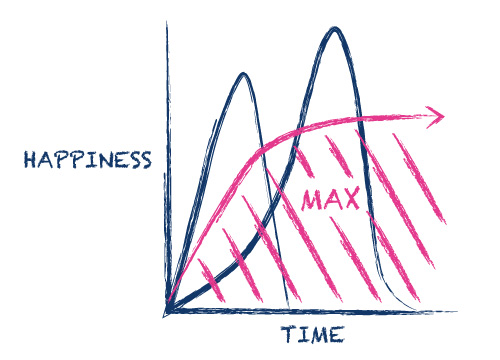

Did you know 40-59-year-old men are the least satisfied and most anxious among all the age groups?

How can this be? Surely we should all be living the dream…

SentinelWealth is conducting research into the experiences, aspirations, and challenges of 45-59-year-old males so that we can assess how best to support this group achieving their “best life”.

We need your help

We are running regular research groups and are currently looking for more participants to help us with this important research.

Suitable participants will be in or close to this age group and or have relevant experience and insight.

What’s in it for you?

In return you will receive –

- A simple meal and refreshments

- A chance to meet some interesting guys

- Your choice of “Life Planning For You” by George Kinder or a personal WealthScan assessment.

- A report that will be the outcome of this discussion, which will be led by a qualified professional.

Please note that no personal information will be sought.

Interested?

Please register for upcoming events or contact us on 02 8908 5300 for more information.

https://sentinelwealth.com.au/wp-content/uploads/2016/05/estate_planning.jpg

300

495

Justin Hooper

https://sentinelwealth.com.au/wp-content/uploads/2016/06/sentinelwealthlogo-300x138.png

Justin Hooper2016-05-30 06:31:592016-06-08 09:12:33Estate Planning

https://sentinelwealth.com.au/wp-content/uploads/2016/05/estate_planning.jpg

300

495

Justin Hooper

https://sentinelwealth.com.au/wp-content/uploads/2016/06/sentinelwealthlogo-300x138.png

Justin Hooper2016-05-30 06:31:592016-06-08 09:12:33Estate Planning